If you are like me, you never make financial mistakes…….…PFFFF!!! Couldn’t even keep a straight face.

Let me start over…If you are like me, you make all kinds of mistakes! Financial and otherwise. There is no perfect recipe for a lifetime free of mistakes. It is difficult to predict the outcomes of all the decisions we make. We all have to manage risk in our lives and sometimes we end up on the wrong side of “Well that was an unlikely scenario.” or “Well I didn’t see that coming.”… (cough…CoronaVirus…cough…)…

If you know what some of the biggest mistakes are, you can take steps to avoid them, or at least be more prepared to weather storms.

So today I’m sharing the 8 common mistakes that I’ve noticed among family, friends and my personal finance coaching clients.

I’m guilty of 6 of the 8 mistakes mentioned below. How many are you guilty of?

8 Common Mistakes Emergency Fund Mistakes:

1. Not having enough money saved

It’s no secret that most Americans don’t have enough money saved for emergencies. Those of you who know my background know that I’m big time guilty of having no and low emergency funds.

Size does matter!

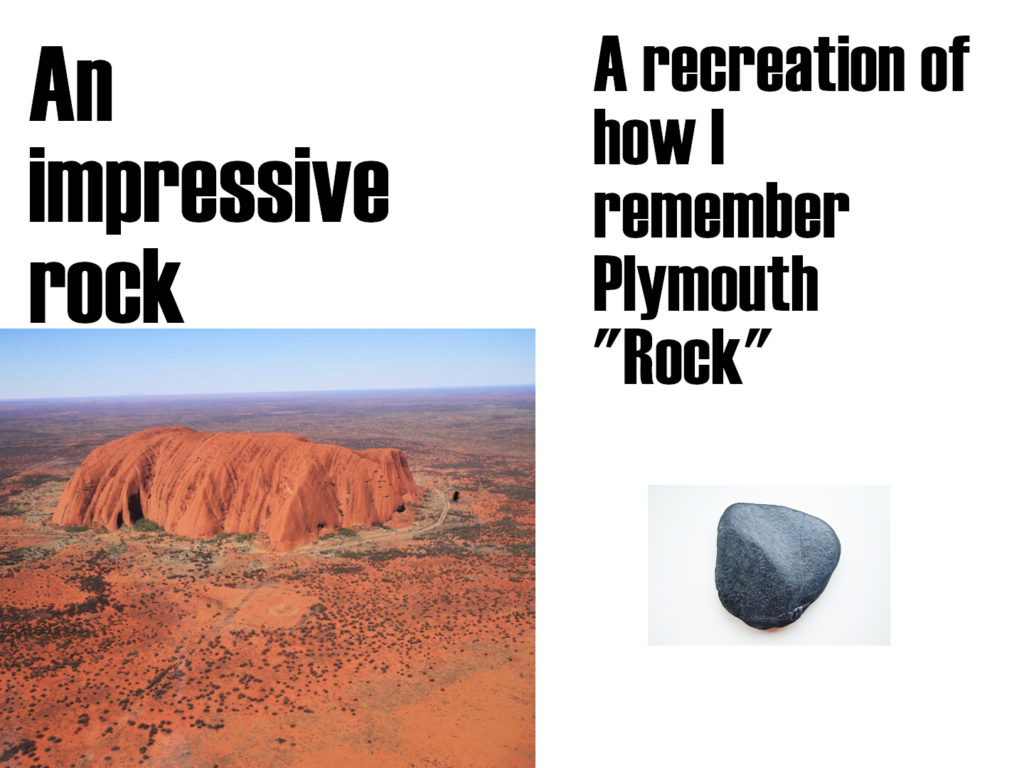

Don’t fall into the trap of having a little bit of money and thinking that “a little is better than nothing” and letting that discourage you from saving more. While it is true that having a small emergency fund is better than none, size does matter! This fund is the only thing standing between you and utter financial chaos and stress. I want my emergency fund to be more like Ayers Rock than Plymouth Rock.

There are many reasons that Americans struggle to build emergency funds including but not limited to; low income, high amount of debt and interest expense, short term gratification and feeling invincible. Since each of these are big topics that deserve full blog posts, I’m just going to talk about the belief that you don’t need an emergency fund because you believe nothing bad is going to happen to you (because I have seen this one a lot recently).

Believing you are invincible

I used to think this was just a naïve young person thing, but recently I learned that this is an every age thing. They say things like “Nothing bad will happen.” Or “Everything will work out.” Or “What else could possibly go wrong?”

Even after having just had surgery, one of my clients recently told me that she is going to prioritize having a “comfortable” apartment (ie. Above average cost for her area) instead of replenishing her emergency fund because she doesn’t think “anything else is going to happen” to her.

A 2018 CIT Bank survey found that about half of Americans experienced an unexpected expense in 2018. Unexpected costs pop up all the time and we need to be aware of that and be as prepared as possible.

2. Raiding Savings

It is possible that you are the biggest threat to your emergency fund. Feathers ruffled? Honestly though, I see people all the time raiding their savings for things that I wouldn’t classify as true emergencies. Cars only run so long, we should expect that they will die eventually so it’s on us to have additional money saved up for a replacement (like a Common Shortage Fund). Christmas comes at the same time every year yet every year people seem surprised when they don’t have money for gifts. Those things are all normal and are going to happen. Are they really on the same level as not having $600 to fly to the East coast to say goodbye to your terminally ill mother? I don’t think so.

“Loaning” the emergency fund to loved ones

This is a re-occurring problem that I’ve seen throughout my life. It started with a cool lady that was friends with my mom who wore leather jackets, rode a motorcycle, and played the piano. One day she came over to our house, sobbing before she even sat down. She explained through her tears that she had loaned her emergency fund (think she just called it her “extra money”) to her brother and now she had lost her job and couldn’t pay her rent. Her brother was unable to pay it back.

There are so many huge hearted, kind, generous people out there who repeatedly struggle because every time they get ahead, they give or loan it to loved ones. And it makes sense, right? “Here’s this money I’m not using right now…so I’ll give it to this person that I love and who needs it.” But this can destroy your finances.

If this is you: I admire you. I love your generous spirit.

My advice: Be generous to yourself too.

You said you needed that money for emergencies so keep your own word to yourself. Get your house in order first, do it right, quickly, and vow to give twice as much in a couple years when you have built a proper and full emergency fund and you can give money that you can actually afford to give.

3. Failure to re-evaluate and update amounts periodically

One of the great things about life is that we are always evolving, and our lives are always changing. If you set your emergency fund dollar amount and then never re-visit the amount, you may have too little or too much set aside for your needs.

As your spending changes, your emergency funds should change as well. New children, buying a house instead of renting, declining health of loved ones and job changes are just of the few changes that should affect the amount of money that you keep in your emergency fund.

The amount of money that you need will likely change multiple times in your lifetime. Set an annual calendar reminder to reflect on whether you need to increase or decrease your emergency fund amounts. I wrote a separate post on how to calculate how much you need in savings here.

4. Low standards

We all would like to have a fully funded emergency fund. However, we don’t get the emergency fund we WANT, we get the emergency fund that we HAVE to have. This idea was inspired by Tony Robbins since he talks a lot about standards in all areas of life. I agree that setting a goal of having $X,XXX dollars is a good thing to do, but it is different than saying, “I MUST have $X,XXX.” There is just a different level of commitment to our “MUSTS”. It will drive us to take action when “WANT” isn’t strong enough.

It may be subconscious, but we all have in our heads, limits on what we are willing to settle for.

When I saw my bank balance at $200 (with no savings), I finally forced myself to take action and get a job. What’s that number for you? What amount would trigger you to change your lifestyle? Is it $200? Is it $0? $0 and maxed out credit cards?

Once you identify the amount, increase it a little bit at a time. Answer this question:

What is the new bare minimum you MUST have in your emergency fund?

“Never again will I have less than $1000″ is what I started with. Overtime that grew to “Never again will I have less than $10,000”.

5. If I have more than $1000, I’ll spend it

This one doesn’t apply to starting an emergency fund, this one is specific to growing an emergency fund.

One of my clients, let’s call him “Ryan”, once told me that “I can’t have more than $1000 or I’ll spend it.”

It’s difficult to build an emergency fund, or any wealth for that matter, if you can’t have more than $1000 at any given time without spending it.

It’s not always $1000 either. We all have a threshold for how much money we consider to be “a lot of money”. Any money acquired after that threshold we feel justified to spend since we are “In a good place” or “Have enough money” or have “Earned it”.

Identify what that number is for you and try to increase that a little at a time until you have your desired emergency fund.

For example: Ryan would say to himself: “If I have more than $1500, I’ll spend it.”

Then once he can regularly keep $1500, he’d raise that to “If I have more than $2000, I’ll spend it”.

6. Using low interest savings accounts

I used to get about 0.01% annual interest on my emergency fund. When I was just starting to save, this wasn’t really a problem since I had so little saved, the amount of interest I missed out on was small and immaterial.

As an emergency fund grows bigger, it becomes more and more important to have that money earning some interest. I prefer to use online savings accounts and CDs for the bulk of our emergency funds so that we can earn at least 1%-3% interest. My brothers used to make fun of me for keeping CD’s, saying that there is no need for them. But honestly, our CDs are about the only thing in our portfolio that are making money right now.

Optimization tho…

I’m all about optimizing our finances. I want to earn the best returns we can because that helps us achieve our goals faster. But I am not comfortable investing our emergency fund in stocks or bonds.

This pandemic is a perfect example of why that is a bad idea. The times when you might need it might be the worst possible time to pull the funds out of the market. I’m willing to trade less interest for having to take losses on principal.

I’ve always had this approach and we are still on track to hit our retirement number at age 39 so I am just not that concerned about having our emergency fund be 100% optimized.

7. Relying solely on credit cards as an emergency fund

I’m guilty of this one. When I was broke and unemployed, I signed up for my first credit card because I was so afraid of running out of money.

This becomes a balancing act; a credit card can be a short term fix for running out of money but it can quickly become it’s own problem that can spiral into massive high interest rate debt and even bankruptcy. I took that card very seriously and thankfully found employment quickly and never used it a single time.

I have always been afraid of debt since my parents struggled so much to pay off the mortgage, second mortgage, car loans, personal debt to family members and, of course, credit cards. The only thing that is worse than having no money, is having negative money. To avoid this, my plan was to use income for emergencies first if possible (having low fixed expenses) and then having cash in the bank account from previous months if need be.

Some people leverage debt successfully, but unfortunately most don’t. Most people become over-leveraged and end up not being able to pay back the money.

8. Not putting Enough “Why” into the emergency fund

This is the final and, in my opinion, biggest mistake that people make.

We need solid, powerful, emotional reasons to accomplish anything. So many people just set an arbitrary number as their emergency fund goal and then wonder why they struggle to save that amount or why they struggle to keep that money.

Emergency funds are just like goals. For every goal we set, we need a clear and specific “Why” behind that goal to keep us motivated on working towards it through tough times. Having a clear and specific “Why” behind our emergency fund will motivate us to keep saving when we feel like giving up.

What would motivate you more?

“I need a $1000 emergency fund.”

OR

“I need to have $950 set aside in case my brother suffers a head injury while skateboarding and I need to go to Seattle to be there for him.”

If the thought popped into my head that I could use my emergency fund for a non-emergency, thinking of my brother in the hospital made it really easy to say “no” to raiding the money.

I went over this quite a bit in the How to get started saving an emergency fund post. Click here to view the post about creating specific “Why” statements behind each emergency fund.

For Discussion in the Comment Section Below:

What mistakes have you noticed that people commonly make with their emergency funds?

How many of these 8 mistakes have you made?

1. Not having enough money saved

2. Raiding Savings

3. Failure to re-evaluate and update amounts periodically

4. Low standards for their emergency fund

5. If I have more than $1000, I’ll spend it

6. Using low interest savings accounts

7. Relying solely on credit cards as an emergency fund

8. Not putting Enough “Why” into the emergency fund